U.S. tariffs disrupt the tech industry: 8 vital things you need to know

Posted by batterymap01

from the Business category at

21 Mar 2025 01:32:46 am.

Look just about anywhere, and you’ll see news of tariffs. A trade war has broken out between the U.S. and select countries—the American government is now imposing taxes on goods arriving from China, select products from Canada, and all steel and aluminum imports.

But while the headlines spout flat numbers like 20 percent on Chinese imports and 25 percent on steel, the tariffs’ effect on tech gear isn’t as clear cut. To understand the whole situation, I spoke with industry insiders. What they said is a sobering warning to consumers: We’re about to get hit hard.

Spoiler: A bumpy ride is headed our way. Buckle up.

Tariffs keep going up

First announced on February 1, the tariff on goods arriving from China began at 10 percent on February 4. Then on February 27, the U.S. government announced a raise to 20 percent, effective March 4th.

Meanwhile on March 12, tariffs of 25 percent started on all steel and aluminum imports. This move increased the tax on aluminum from 10 percent. No exemptions are allowed.

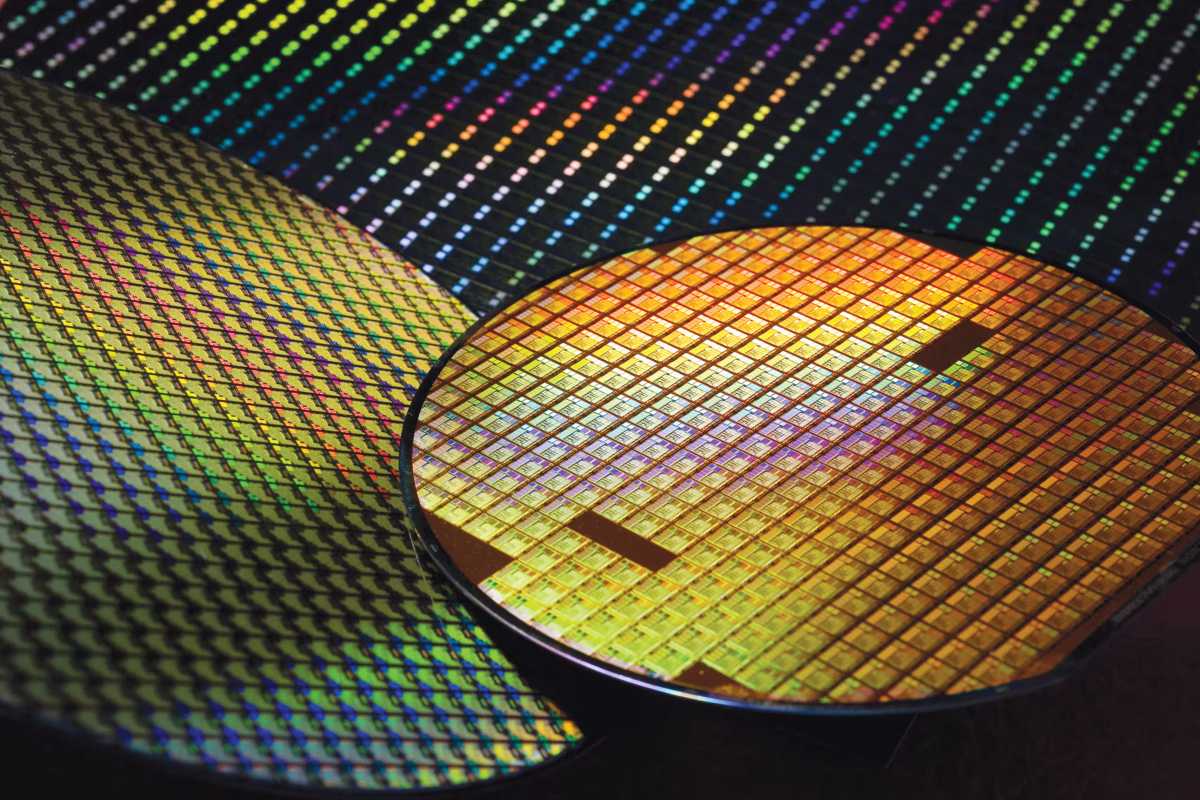

Currently, the U.S. government continues to suggest future tariffs, along with potential increases. For example, in mid-February, President Trump proposed a25 percent tariff upon semiconductorsstarting April 2, with the possibility of raising them much higher over time.

These tariffs can stack—for example, any steel and aluminum imports from China would betaxed at a 45 percent rate.

>>>AP19B5K Battery for Acer Aspire 7 A715-42 A315-56-57 CB315-3H

Buy soon to avoid paying higher prices

Companies don’t make a lot of money on tech products. Think 6 to 15 percent—a stark contrast to software, which has profit margins as high as 70 to 80 percent. Because of this reality, businesses that import goods from their factories in China can’t absorb this sudden tax hike. It’s too big.

Retailers also can’t cushion the blow, as evidenced byBest Buy and Targettelling shoppers to expect immediate price increases.

For some devices, you can still find them at lower prices—either reflecting “just” the effect of the original 10 percent tariff, or even the pre-tariff cost. Your luck will depend on how much stock was brought over before the March tariffs took effect.

The more popular the product, the more likely a constant stream of units come from China, rather than one big shipment. Its price will go up faster. For items that sell more slowly or have a bigger sitting inventory, the tariffs will have a more delayed impact.

The short version: Currently, the sooner you buy a new device, the cheaper it’ll be.

>>>AP20A7N Battery for Acer Predator Triton 300 SE PT314-51S

All tech devices are affected

During the first Trump administration, tariffs were applied selectively. This time, these taxes apply across the board on all imports from China—the primary source for most electronics produced in the world.

So whether a laptop or a cheap printer, if it’s produced in China, it’s subject to this tax. Same goes for even the smallest of accessories, like adapters and cables.

Manufacturers have already begun looking into moving production (or more of their production) to other countries, like Vietnam and India. However, the process is slow. Building up factories capable of complex production demands takes time — months, if not years, depending on the product.

>>>AP18H18J Battery for Acer N18P5 P215 TMP215-51G Spin3 SP314-53

Expect ongoing price chaos

Nobody knows what’s going to happen next—which is why the tariffs keep appearing in the news. And businesses are scrambling to keep up. Your favorite companies can’t give a straight answer on what to expect because they’re still figuring that out for themselves.

Any predictions they made for the year (forecasts) have to now be redone. However, the task is hard to do when the tariffs keep rising and spreading, and more may still come. Companies have to pay upfront for tariffs in order to pass customs. This unexpected cost can’t be deferred; the duties must be paid for the product to enter the U.S.

When I spoke with industry insiders, many said they were still talking with their partners (like distributors and retailers) about what comes next. But even when that gets worked out now, it will likely change as U.S. government policy changes.

Overall, any price shifts will be unpredictable—even on a downward trajectory. Even if tariffs suddenly went away, costs will drift down based on how stable U.S. fiscal policy is, and how much remaining stock was brought into the country during the levies.

People outside the U.S. will feel the hit, too

Economists view tariffs as problematic—in the country that enacts them, they can slow the economy, hurt local industries, and spike costs for consumers. But a trade war can hurt more than just the country that starts them. Most vendors think globally when setting up their production, and that’s reflected in their logistics.

So for example, when Canadians buying from a store that utilizes a U.S-based fulfillment center, they’ll feel the pinch of the U.S.’ tariffs on Chinese imports, too.

But most tech vendors sell worldwide—so the impact of higher production costs will still ripple outward to buyers across the globe, in a couple of different ways. (Read on.)

MSRPs will be even more meaningless

Manufacturers give list prices so consumers know what to expect at retail. But as vendors absorb more production costs (like scaling up factory output in countries outside of China) and scale back on the amount of product available (because demand drops as prices rise), we may be in for another round of highly inflated street prices.

Multiple industry insiders say they don’t want to be caught with too many parts or products on hand that they can’t sell. Other ancillary costs may go up as well as companies scramble to comply with tariff demands—more hours must be spent on figuring out new logistics, as well as the full letter of the law.

If Nvidia, AMD, or Intel launch a new GPU at $200, but partners’ rising costs limit their ability to shave their margin thinner or even produce as many cards, that means demand may cause street prices to shoot way beyond the expected list price.

Innovation may slow

Industry insiders have hinted that without a stable economic environment, investment in new products may become more limited. The size of the company and how diverse its product lineup will influence the ability to commit.

On store shelves, that may result in fewer choices for available models, or less push on evolving standard features. Announced specs like Wi-Fi 7 and PCIe 7.0 might become an even further point in the distance.

You should read reviews carefully

As someone who writes reviews, I always want to think people read every word. But realistically, most people don’t—and if you’re looking for high value from your purchases, you could end up disappointed. With prices changing unpredictably, the final opinions in tech reviews may become outdated by the time you read them.

So in this uncertain market, dig into a review’s details. Find out what user experience to expect, the level of performance, and what quirks exist.

Since street prices could end up notably different than the MSRP quoted to the reviewer, you’ll need to decide for yourself if the actual price is worth the experience.

Tags: U.S. tariffs

0 Comments